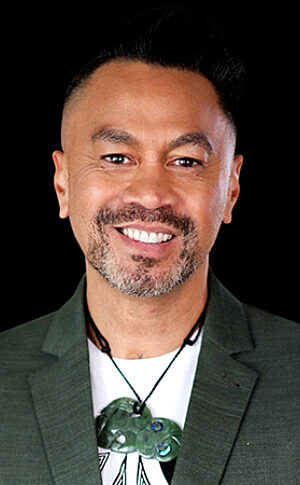

Paul Adams is the CEO of EverEdge, a global advisory, corporate finance and investment firm specialising in intangible assets.

EverEdge helps companies and capital providers convert intangible assets (such as data, design, inventions, brands, software and content) into business impact: increased margins, market share and enterprise value. Paul has been ranked as one of the top intellectual property strategists in the world for the last nine years consecutively and is a prior recipient of the Global IP Leader Award.

Paul is a respected director of several New Zealand and Singapore based organizations and is also a Founding Chair of Weave® - the New Zealand Centre for Leadership Excellence.

Prior to EverEdge, Paul served as Intellectual Property Manager for the New York Stock Exchange listed Brunswick New Technologies. He was the founding incubator manager of The Icehouse Incubator, named one of the top 10 technology incubators in the world by Forbes magazine. He has served on the advisory board of the New Zealand government's commercialisation vehicle Callaghan Innovation and on the Board of Lewis Holdings, a $350M private investment vehicle.

Talking Points

Why Some Companies (and National Economies) Consistently Outperform Others.

Why Some Companies (and National Economies) Consistently Outperform Others.

How Management Teams can Drive Growth and Enhance Competitive Advantage.

How Management Teams can Drive Growth and Enhance Competitive Advantage.

How Nimble Companies Adopt New Business Models and Strategies to Increase Company Performance.

How Nimble Companies Adopt New Business Models and Strategies to Increase Company Performance.

How C-Suites can Leverage Existing Assets to Negotiate Better Deals, M&A and Joint Ventures.

How C-Suites can Leverage Existing Assets to Negotiate Better Deals, M&A and Joint Ventures.

How Business Owners and Investors can Exit or Raise Capital at Materially Higher Valuations

How Business Owners and Investors can Exit or Raise Capital at Materially Higher Valuations

How Governments can Guide Policy Settings to Unlock Economic Growth and Drive Value Creation.

How Governments can Guide Policy Settings to Unlock Economic Growth and Drive Value Creation.

Why many Investors and Financial Institutions Overlook Key Opportunities and Critical Risks by Relying too Heavily on Conventional Financial Analysis.

Why many Investors and Financial Institutions Overlook Key Opportunities and Critical Risks by Relying too Heavily on Conventional Financial Analysis.

Why too many Boards Focus on the Wrong Areas and are Blind-sided by Major Risks

Why too many Boards Focus on the Wrong Areas and are Blind-sided by Major Risks